Discover the Ultimate Overview to Real Estate Investment Methods for Newbies

Realty investment can be a rewarding endeavor for those wanting to grow their wealth in time. As a novice in this facility and vibrant area, browsing the plethora of financial investment strategies can be a complicated job. From recognizing the basic concepts of realty financial investment to selecting the best method that lines up with your monetary goals, there is much to think about. Whether you strive to produce easy earnings with rental buildings or look for to make money from property appreciation, the key hinge on crafting a well-thought-out investment strategy. In this utmost overview, we will explore the fundamental principles and sensible pointers that can establish you on the path to success in property investment.

Comprehending Property Financial Investment Basics

In order to embark on an effective real estate financial investment trip, it is vital to grasp the basic fundamentals of the market. Realty financial investment entails the purchase, ownership, management, rental, or sale of real estate commercial. Comprehending crucial ideas such as market analysis, building assessment, financing alternatives, and danger management is vital for making informed financial investment choices.

Market analysis is a vital component of realty financial investment, as it includes reviewing supply and demand characteristics, financial indicators, and neighborhood market trends - Winnipeg real estate agent. Residential property valuation is one more essential skill, as financiers require to accurately examine the value of a building based on aspects like area, problem, and possibility for gratitude

Funding options play a considerable function in realty financial investment, with investors having the option between different resources of funding such as mortgages, finances, or partnerships. Reliable threat monitoring approaches, consisting of diversity, insurance coverage, and complete due persistance, are essential for mitigating potential economic losses in the unpredictable actual estate market. Grasping these essential fundamentals sets a solid foundation for an effective realty financial investment journey.

Selecting the Right Investment Strategy

Selecting the optimum financial investment strategy is a crucial decision that can dramatically impact the success of a genuine estate endeavor. When choosing the best investment approach, beginners in genuine estate must take into consideration several essential aspects to straighten their goals with the most appropriate technique.

Following, assess your risk tolerance - Winnipeg real estate agent. Genuine estate financial investments can vary from low-risk, stable options like rental residential or commercial properties to higher-risk, potentially higher-reward ventures such as home flipping or property growth. Recognizing how much risk you fit with will aid limit the appropriate methods for you

Financing Choices for Beginners

Considering the relevance of straightening your financial investment technique with your financial resources, it is vital for novices in real estate to discover ideal financing options. Discovering these funding opportunities is vital for novices to figure out the most appropriate option based on their economic circumstance and investment objectives. By recognizing these funding options, newbies can make educated decisions when getting started on their genuine estate investment trip.

Risk Monitoring and Due Persistance

Conducting due diligence is crucial prior to buying any residential or commercial property. This includes investigating the marketplace fads, building worths, possible rental income, and any type of lawful problems associated with the residential or commercial property. Beginners need to additionally examine the property thoroughly, including its problem, prospective repair work, and conformity with building regulations and policies.

Moreover, looking for guidance from knowledgeable experts like property representatives, residential or commercial property supervisors, and legal experts can supply valuable understandings and ensure a smoother financial investment process. By focusing on danger monitoring and due diligence, newbies can enhance their opportunities of success in property financial investment while minimizing possible mistakes.

Structure a Successful Investment Profile

Crafting a diverse and durable property investment profile is a basic purpose for newbies seeking long-term success in the industry. Developing an effective investment profile in actual estate entails greater than just obtaining homes; it calls for a strategic technique that considers various elements. Novices must begin by defining their investment goals, danger tolerance, and investment horizon. Diversity is vital to mitigating risk, so spreading investments across different sorts of buildings and locations can help protect against market changes.

Furthermore, beginners need to carry out extensive market research study to recognize emerging trends and possible growth locations. This info will certainly assist decision-making when choosing properties that straighten with their investment objectives. In addition, comprehending the financing choices available and structuring bargains efficiently can maximize returns and reduce prices.

Frequently reviewing and readjusting the financial investment profile is vital to adapt to altering market problems and guarantee ongoing development - Winnipeg real estate agent. By complying with these concepts and remaining disciplined in their financial investment method, novices can construct a successful genuine estate financial investment portfolio that produces lasting returns over time

Final Thought

Finally, property financial investment offers different approaches for beginners to check out. By comprehending the essentials, choosing the best method, making use of financing choices, taking care of risks, and conducting due diligence, financiers can construct an effective profile. It is necessary to approach realty financial investment with mindful consideration and planning to make best use of returns and minimize potential risks. By complying with these guidelines, novices can navigate the world of realty financial investment with self-confidence and success.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Burke Ramsey Then & Now!

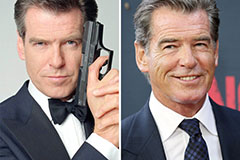

Burke Ramsey Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!